carried interest tax reform

US Senate Democrats agree to 14bn carried interest tax reform. Tax reform introduced new rules seeking to increase the likelihood that fund managers carried interest would be taxable as ordinary income rather than long-term capital gain.

Earlier efforts to reform carried interest taxation had stalled before US Senator Joe Manchin announced on Wednesday that he and Senate Majority Leader Chuck Schumer had worked out a deal.

. According to the most recent figures from the Joint Committee on Taxation treating carried interest as ordinary income would raise only 132 billion in 2016 and 1564 billion over ten years. The proposal approved by the House Ways and Means Committee in September which is part of a large tax and spending package currently being debated in Congress aims to change the law to significantly modify the so-called carried interest loophole by limiting situations that are eligible for the more tax favored long term capital gain LTCG treatment. Increasing taxes on carried interest is bad policy that fails to raise any significant amount of revenue and undermines pro-growth tax reform.

Earlier efforts to reform carried interest taxation had stalled before US Senator Joe Manchin announced on Wednesday that he and Senate Majority Leader Chuck Schumer had worked out a deal. A Tax Increase on Carried Interest Capital Gains Would Harm Economic Growth. Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street.

Earlier efforts to reform carried interest taxation had stalled before US Senator Joe Manchin announced on Wednesday that he and Senate Majority Leader Chuck Schumer had worked out a deal. Regular income is taxed at a top rate of 37 though the exact rate depends on various factors such as a taxpayers income and other. NMHCNAA believe that carried interest should be treated as a long-term capital gain if the underlying asset is held for at least one year.

Many view a tax increase on carried interest is just the first step. House Committee on Ways and Means. The carried interest tax is a direct attack on the structure of partnerships that are used by innovative businessesfrom small firms to venture capital and angel investors that take risks and make an outsized contribution to economic growth and job creation.

Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka carried interest held by the sponsors of private equity hedge venture capital and other investment funds that are structured as flow-through entities. US Senate Democrats agree to 14bn carried interest tax reform. The Outline of the 2021 Tax Reform Proposals Proposal which was agreed by the ruling coalition in December 2020 described that where the distribution ratio has economic rationality etc.

In which the fund managers have an equity interest. Dropping the carried interest tax provision from the Inflation Reduction Act cost 14 billion in projected revenue but Schumer made up for it by adding an excise tax on stock buybacks that will. The goal of Democrats is to increase taxes on all capital gains.

Currently capital gains are taxed at a maximum rate of 238. Eugene Steuerle gave testimony on the taxation of carried interest before the US. The graph above puts the treatment of carried interest in the context of other well-known provisions of the tax code.

The 725-page revival called the Inflation Reduction Act of 2022 the Act contains tax proposals that. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital. US Senate Democrats agree to 14bn carried interest tax reform.

The last-minute removal by Senate Democrats of a provision in the climate and tax legislation that would narrow what is. WASHINGTON Once again carried interest carried the day. Unfortunately the legislation was drafted hastily and there are many questions which will need to be addressed either by further legislation or by regulation.

I change the tax treatment of carried interests. For the Carried Interest that the fund managers receive from the partnership whose business is transfer of shares etc. Ii create a new corporate.

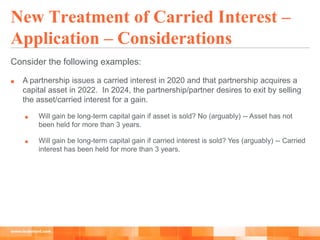

Where a partnership interest or the underlying partnership asset being sold has been held for three years or less Section 1061 converts the treatment of the gain from long-term capital gain taxed at preferential rates to short-term capital gain generally taxed at ordinary income rates with respect to a certain partnership interest an applicable partnership interest. He notes among his findings that as a matter of both efficiency and equity capital gains relief is best targeted where tax rates are high as in the case of the double taxation of corporate income. The industry strongly opposed extending the holding period to three years as part of tax reform legislation enacted in 2017 but notes that final regulations released in January 2021 exclude Section 1231 gains.

How To Tax Capital Without Hurting Investment The Economist

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Tax Reform Issues And Opportunities A Primer For Mlps Pe Funds A

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

How Should Progressivity Be Measured Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do Taxes Affect Income Inequality Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Relationship Between Taxation And U S Economic Growth Equitable Growth

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Private Equity Won Its Battle Over Carried Interest Barron S

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

:strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)